Debt Service Coverage Ratio Guide on How to Calculate DSCR

On the other hand, if a company has a low Interest Coverage Ratio, it means that the company is not generating enough earnings to cover its interest payments. This can lead to financial distress, as the company may struggle to meet its debt obligations and may be at risk of default. One limitation of the debt service ratio is that it doesn’t work interest coverage ratio upsc well for new businesses. A new business won’t have a track record of net income, so any debt service ratio calculation will show an inability to repay debt. Therefore, these businesses may struggle to secure a business loan, and they may have to seek creative financing methods until they can demonstrate enough net income to offset debt service.

Credit Suisse intends to borrow up to 50 bn Swiss francs from Swiss National Bank – The Indian Express

Credit Suisse intends to borrow up to 50 bn Swiss francs from Swiss National Bank.

Posted: Thu, 16 Mar 2023 07:00:00 GMT [source]

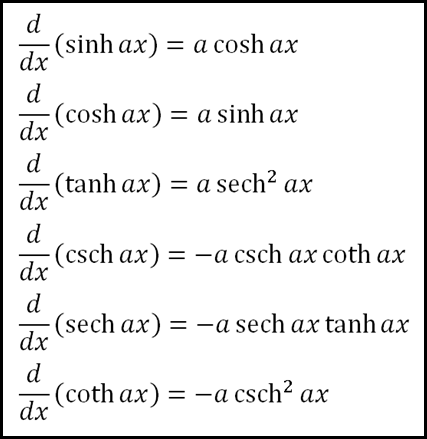

EBIAT can be used to compute interest coverage ratios instead of EBIT to get a better view of a company’s capacity to cover its interest expenses. The interest coverage ratio is a financial metric that assesses a firm’s capacity to make timely interest payments on its debt. This liquidity ratio, unlike the debt service coverage ratio, has nothing to do with the ability to make principal payments on the debt. The interest coverage ratio, or times interest earned (TIE) ratio, is used to determine how well a company can pay the interest on its debts and is calculated by dividing EBIT (EBITDA or EBIAT) by a period’s interest expense. Generally, a ratio below 1.5 indicates that a company may not have enough capital to pay interest on its debts.

What Does a Bad Interest Coverage Ratio Indicate?

If the resulting value of this ratio is low, less than 1, it is a strong indication that any significant decrease in profits could bring about financial insolvency for a company. A high ratio is indicative of a greater level of financial soundness for a company. The interest coverage ratio is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expense during a given period. The interest coverage ratio is sometimes called the times’ interest earned (TIE) ratio.

Hence, the ability of a bank to disburse loans to companies and individuals reduces. It can further lead to an economic slowdown, hence reducing the capacity of individuals to avail of loans and the ability of businesses to expand. A Solvency ratio can be recognized as one of the key metrics to determine whether an organization can stay solvent or not in the long term. It is a comprehensive measure of solvency (liquidity) as it essentially measures the organization’s actual cash flow instead of the net income. It does so by adding back the depreciation and all the other non-cash expenses to assess an organization’s potential to stay afloat. A bad interest coverage ratio is any number below 1, as this translates to the company’s current earnings being insufficient to service its outstanding debt.

She has enough money to pay both the interest and the principle on her present obligation. This is a positive sign because it indicates that her company’s risk is low and that her operations are generating enough cash to cover her expenses. In terms of risk management, the interest coverage ratio can be a useful tool for determining whether your company’s revenues are sufficient to cover the interest on its loan commitments. Start with our interest coverage ratio definition to learn everything you need to know. Because we covered all you need to know about interest coverage ratio, formula, types, analysis and so much more. Companies need to have more than enough earnings to cover interest payments in order to survive future and perhaps unforeseeable financial hardships that may arise.

What Is the Interest Coverage Ratio?

The features, benefits and offers mentioned in the article are applicable as on the day of publication of this blog and is subject to change without notice. The contents herein are also subject to other product specific terms and conditions and any third party terms and conditions, as applicable. Every asset that can be easily and instantly converted into cash at minimum or no cost of value is a High-Quality Liquid Asset. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. Some businesses require constant reinvestment in order to remain competitive. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

The Debt Service Ratio, or debt service coverage, provides a useful

indicator of financial strength. Standard & Poors reported that

the total pool consisted, as of June 10, 2008, of 135 loans, with

an aggregate trust balance of $2.052 billion. They indicate that

there were, as of that date, eight loans with a DSC of lower than

1.0x. This means that the net funds coming in from rental of the

commercial properties are not covering the mortgage costs.

Take the net operating income of your business and divide it by your total debt obligations such as business loans. For example, if your net operating income is $100,000 and your debts total $100,000, the ratio would be 1. While debt service may be a large part of a business’s expenses, it’s not the only one. Net operating income accounts for these expenses, so it doesn’t affect the accuracy of the debt service ratio. However, the debt service ratio won’t tell you many details about a business’s expenses. For analysts who want to dig into expenses, they’ll need to use other calculations and measurements.

Debt Service: An Important Key to Business Credit

In order to weather future, and maybe unanticipated, financial crises, businesses must have more than enough earnings to cover interest payments. The ability of a corporation to satisfy its interest obligations is a measure of its solvency, and thus a key determinant in shareholder returns. The interest coverage ratio, on the other hand, is used by creditors to determine if a company can afford the extra debt. If a corporation can’t afford to pay the interest on its debt, it will most likely be unable to pay the principal. As a result, creditors utilize this formula to determine the risk of lending.

- It is a useful tool for investors and creditors who want to assess a company’s risk profile and potential for growth.

- The solvency ratio is an essential measure to figure out the solvency of an organization, and assess the financial condition concerning their competitors in the same industry, quantitatively.

- This indicates that the business has the ability to pay off its debt obligations.

- Federal Realty Investment Trust, a REIT, lists fixed-rate debt (principal and interest), capital lease obligations (principal and interest), variable rate debt (principal only) and operating leases among its fixed charges.

Another variation uses earnings before interest after taxes (EBIAT) instead of EBIT in interest coverage ratio calculations. This has the effect of deducting tax expenses from the numerator in an attempt to render a more accurate picture of a company’s ability to pay its interest expenses. Because taxes are an important financial element to consider, for a clearer picture of a company’s ability to cover its interest expenses, EBIAT can be used to calculate interest coverage ratios instead of EBIT. A business has two short-term loans that total (with principal and interest) $100,000.

Debt Service Coverage Ratio & Financial Analysis

Otherwise, even if earnings are low for a single month, the company risks falling into bankruptcy. Moreover, the desirability of any particular level of this ratio is in the eye of the beholder to an extent. Some banks or potential bond buyers may be comfortable with a less desirable ratio in exchange for charging the company a higher interest rate on their debt. Staying above water with interest payments is a critical and ongoing concern for any company.

Looking at a company’s interest coverage ratios on a quarterly basis for the past five years. For example, can tell investors if the ratio is improving, dropping, or stable, and can give you a good idea of how healthy its short-term finances are. The smaller the ratio, the more debt expenses burden the corporation and the fewer resources it has to invest elsewhere. A company’s capacity to meet interest expenses may be questioned if its interest coverage ratio is below 1.5 or lower. For example, during the recession of 2008, car sales dropped substantially, hurting the auto manufacturing industry. A workers’ strike is another example of an unexpected event that may hurt interest coverage ratios.

Limitations of the Interest Coverage Ratio

The ICR measures a company’s ability to pay interest on its debt obligations. A higher ratio indicates that a company is more capable of meeting its interest obligations, while a lower ratio indicates that it may be at risk of defaulting on its debt. In addition to providing insight into a company’s ability to meet its debt obligations, the Interest Coverage Ratio is also useful for comparing companies within the same industry. For example, if two companies have similar debt levels but one has a higher Interest Coverage Ratio, it may be a better investment because it is generating more earnings to cover its interest payments. To calculate an entity’s debt coverage ratio, you first need to determine the entity’s net operating income (NOI).

NOI is meant to reflect the true income of an entity or an operation without or before financing. Thus, not included in operating expenses are financing costs (e.g. interests from loans), personal income tax of owners/investors, capital expenditure and depreciation. The interest coverage ratio measures a company’s ability to handle its outstanding debt. It is one of a number of debt ratios that can be used to evaluate a company’s financial condition. The term “coverage” refers to the length of time—ordinarily, the number of fiscal years—for which interest payments can be made with the company’s currently available earnings. In simpler terms, it represents how many times the company can pay its obligations using its earnings.

Two Wheeler Loan

For companies with historically more volatile revenues, the interest coverage ratio may not be considered good unless it is well above three. The interest coverage ratio is sometimes called the times interest earned (TIE) ratio. Lenders, investors, and creditors often use this formula to determine a company’s riskiness relative to its current debt or for future borrowing.

ICICI Bank net profit up 34% to Rs 8,312 cr – The Indian Express

ICICI Bank net profit up 34% to Rs 8,312 cr.

Posted: Sun, 22 Jan 2023 08:00:00 GMT [source]

Other industries, such as manufacturing, are much more volatile and may often have a higher minimum acceptable interest coverage ratio of three or higher. One such variation uses earnings before interest, taxes, depreciation, and amortization (EBITDA) instead of EBIT in calculating the interest coverage ratio. Because this variation excludes depreciation and amortization, the numerator in calculations using EBITDA will often be higher than those using EBIT. Since the interest expense will be the same in both cases, calculations using EBITDA will produce a higher interest coverage ratio than calculations using EBIT. When the financial crisis hit, many banks worldwide faced a liquidity shock. They didn’t have enough assets that could be converted into cash to avoid defaulting.

Leave A Reply